Am I Paying Too Much in Property Taxes? Should I file a tax appeal?

Am I paying too much in property taxes, and am I a good candidate to appeal them?

Now that tax season is upon us, and the deadline to file taxes is looming, that thought may have crossed your mind, especially for those of us who live in Union County!

You might fear that figuring this out is too complicated, but it is actually pretty simple. The rule of thumb is that the town’s value of your home must be off by approximately 15% in order to be a good candidate for a tax appeal.

Here’s how to figure out if you are paying too much in property taxes, and if you are a good candidate to appeal your property taxes:

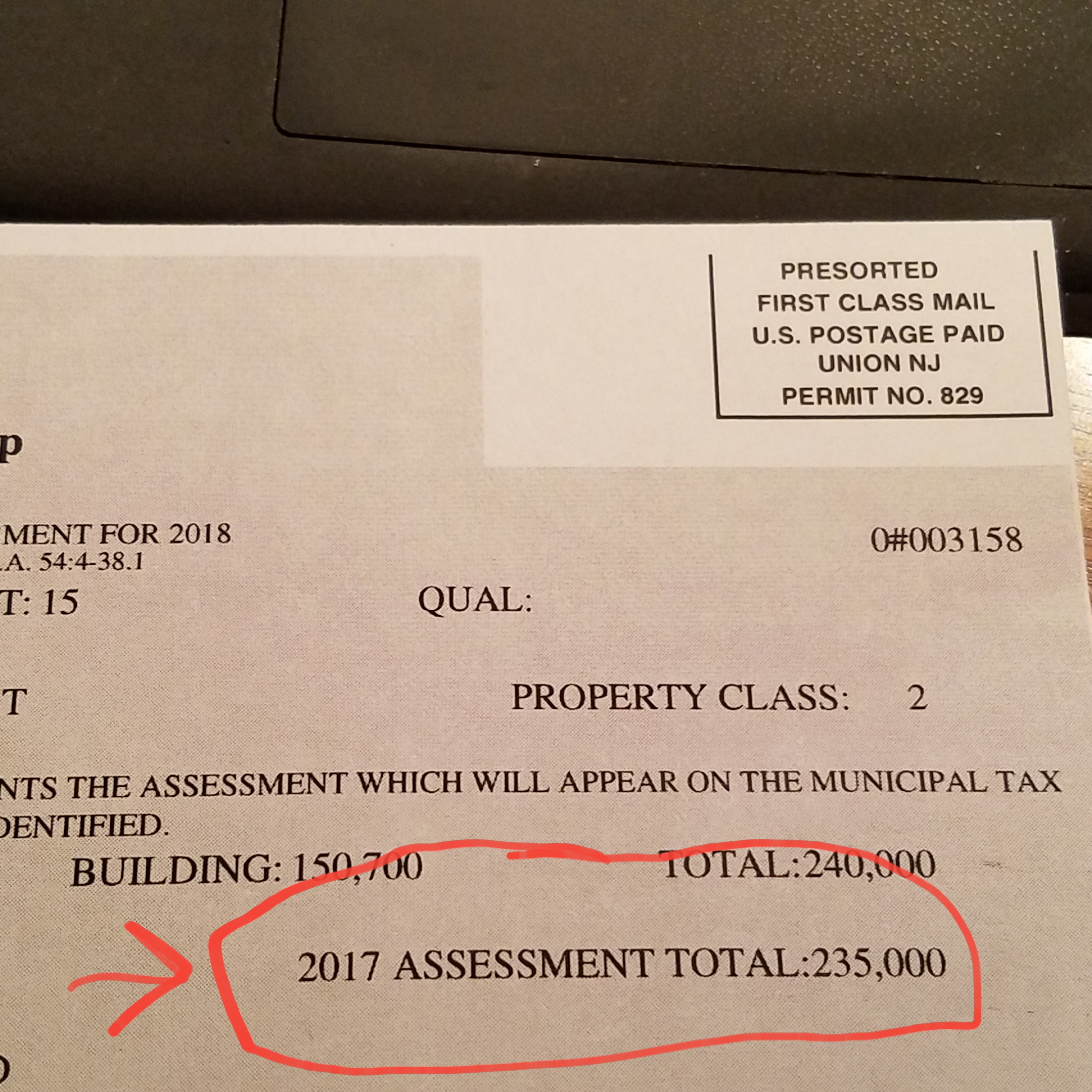

1. Determine the Assessed Value of your home.

Look at your tax bill to find Assessed Value.

See pic below, the Assessed Value is the 2017 ASSESSMENT TOTAL (here, 235,000).

2. Determine the Market Value of your home.

A real estate agent can perform a Market Analysis for your home, to give you an approximate Market Value. If you would like a Complementary Market Analysis, please contact me and I will be happy to do it for you 🙂

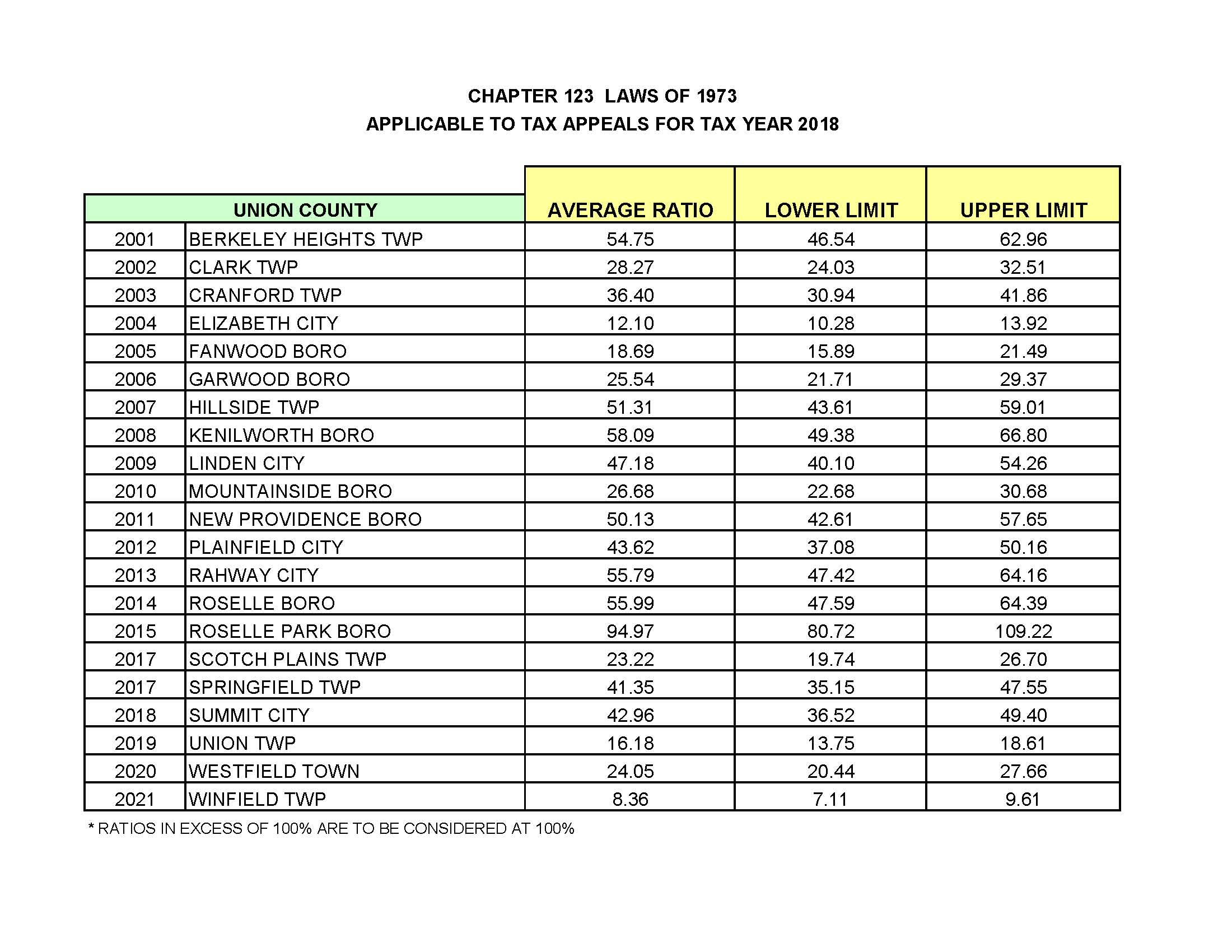

3. Divide Assessed Value by the Upper Limit for your town as per chart * below, then compare to Market Value:

Now, let’s take Assessed Value and divide by the Upper Limit as per chart:

In the example, we are in Cranford. The Upper Limit is 41.86 (or .4186). And from Step 1, Assessed Value is 235,000.

235,000/.4186 = $561,395.

The Market Value of this home would have to be lower than $561,395 in order to be a good candidate for a tax appeal.

Why is that?

The homeowner is paying taxes based on an approximate town value of $645,395, the Assessed Value/Average Ratio (235,000/.3640 = $645,395) .

Remember, as discussed earlier, the rule of thumb is that the town’s value of your home must be off by approximately 15% in order to be a good candidate for a tax appeal. The Upper Limit is the 15% threshold to determine if you are a good candidate for a tax appeal.

* I’ve only shown Union County here, for other towns please reach out to me and I will be happy to provide!

4. File Your Tax Appeal!

Are you a good candidate for a tax appeal? Contact your local Tax Department to file your tax appeal, or file your appeal directly on the Union County website here

The deadline is April 1 for tax year 2018.

Note: In Westfield, you can still file a property tax appeal during the current revaluation process. Contact the Tax Assessor for more details.

To find if you qualify for special considerations (exemptions based on Senior citizen status, Veteran status, etc.), please contact a real estate attorney or your Tax Assessor.

There! That wasn’t too bad, right? Of course, if you have any questions, please feel free to contact me and I will be happy to help you!