Your Credit Score: What is it, and What Does it Mean?

You probably know that in order to obtain a good interest rate on your mortgage, you need to have a good credit score. That’s why you should know what your credit score is, understand what it means, and if necessary, how to improve it so that you get the best interest rate possible on your mortgage!

So let’s break it down!

What is a Credit Score?

A credit score is a number calculated using information from your credit history. The credit history information comes from credit reporting agencies. Credit scores represent your creditworthiness and indicate the likelihood that you will repay a debt as agreed. They are widely used by lenders. If you have car insurance, a loan or credit cards, the premiums you are paying and your interest rates may be determined in part by your credit scores.

What Does My Credit Score Mean?

Credit scores are numbers lenders use to help them decide how likely it is that they will be repaid on time if they give you a loan or a credit card. Credit scores also are called risk scores because they help lenders assess the risk that you won’t be able to repay the debt as agreed. Your scores are generated by statistical models using elements from your credit report. However, credit scores are not stored as part of your credit history. Rather, scores are generated at the time a lender requests your credit report and are delivered with the report.

What Determines my Credit Score?

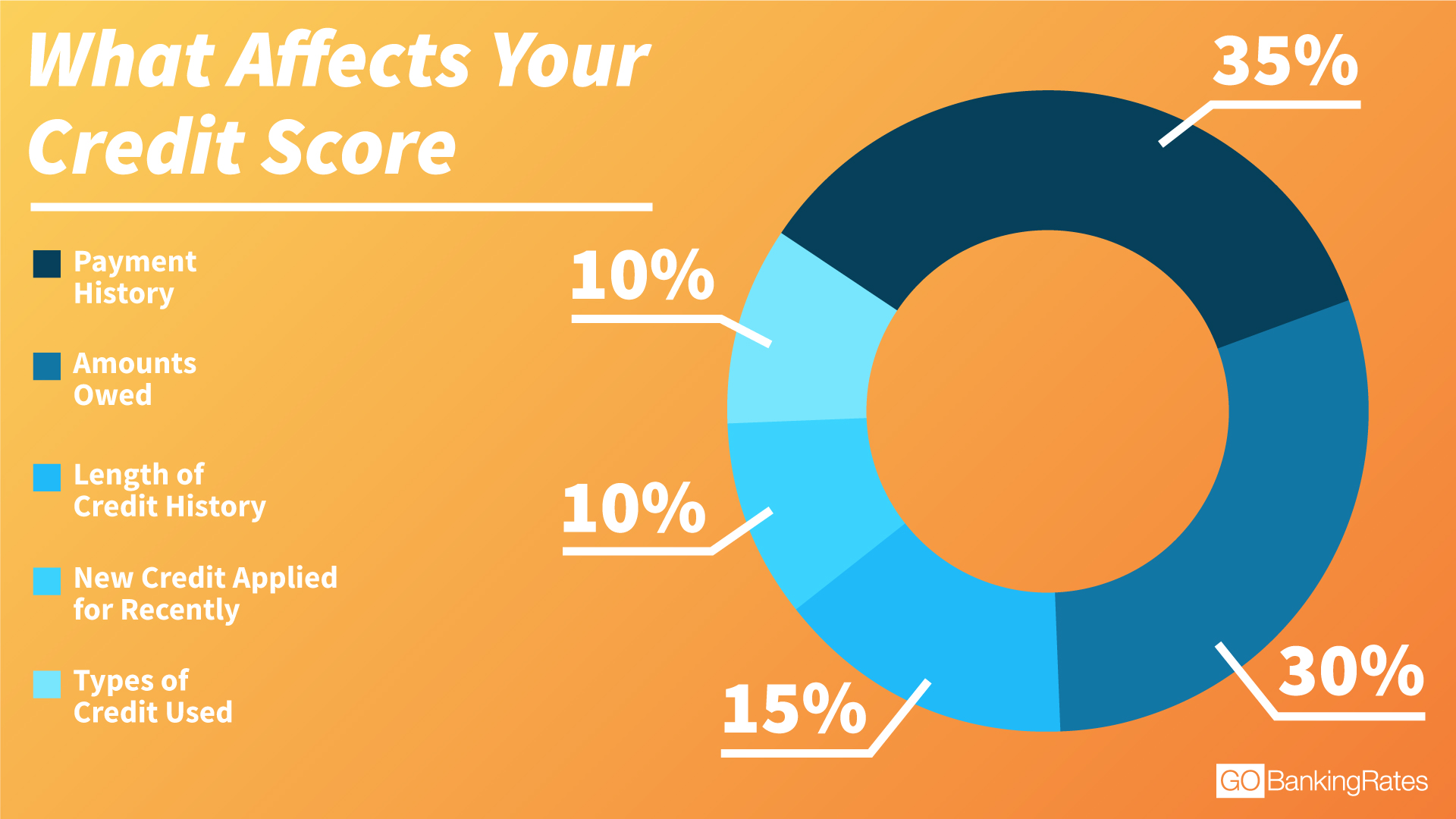

5 factors credit bureaus use to determine your credit score (Source: GOBankingRates):

- Your payment history : 35%

- Amount you currently owe creditors: 30%

- Length of your credit history: 15%

- New Credit Applied for Recently: 10%

- Mix of credit accounts you have (mortgages, credit cards, installment loans, etc.): 10%

SO, is My Credit Score Good?

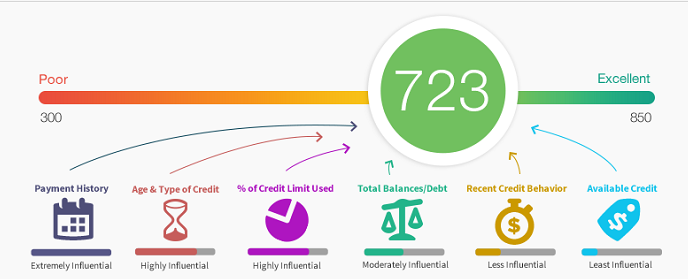

For a score with a range between 300-850, a credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent. Most credit scores fall between 600 and 750. Here is a breakdown:

FICO Score Ranges:

| Credit Score | Rating | % of People | Impact |

| 300-579 | Very Poor | 17% | Credit applicants may be required to pay a fee or deposit, and applicants with this rating may not be approved for credit at all. |

| 580-669 | Fair | 20.2% | Applicants with scores in this range are considered to be subprime borrowers. |

| 670-739 | Good | 21.5% | Only 8% of applicants in this score range are likely to become seriously delinquent in the future. |

| 740-799 | Very Good | 18.2% | Applicants with scores here are likely to receive better than average rates from lenders. |

| 800-850 | Exceptional | 19.9% | Applicants with scores in this range are at the top of the list for the best rates from lenders. |

How Can I Improve my Credit Score?

- Stay current on existing accounts. One late payment of 30 days or more can lower your credit score.

- Don’t max out credit cards. Using more than 30% of your available credit limit can lower your credit score.

- Don’t close credit card accounts. Closing longstanding accounts can shorten the length of your credit history.

- Don’t apply for new credit. You can potentially lose points from your credit score when a potential creditor pulls your credit.

- Continue to use your credit normally. Changing your credit pattern will raise a red flag and can lower your credit score.

Moving Forward

Now that you have the lowdown on credit score, you have the information you need to improve it if needed before getting a mortgage, or if it’s already in good shape, move confidently forward!